Reducing and offsetting – 3 reasons you should embrace both to reach your net-zero targets

In the battle against climate change, leveraging every available tool is crucial. Immediate and long-term strategies, such as carbon offsetting and systemic emission reductions, are vital for tackling current emissions and addressing the underlying factors contributing to climate change.

Summary

- Reducing and offsetting carbon emissions are both crucial in order to achieve net-zero targets.

-

Businesses should leverage both emission reduction and offsetting strategies for three important reasons. First, while emission reduction projects take time to implement, offsetting provides an immediate solution to mitigate current emissions.

Second, carbon credits offer essential funding and mechanisms to support emissions reduction efforts. Finally, combining reduction with offsetting strategies helps address historical emissions, ensuring a more comprehensive approach to sustainability.

- Selecting high-impact carbon credit projects that align with a company’s values and sustainability goals takes time and thorough due diligence. Some considerations to guide your decision when selecting a carbon project to invest in includes: financial transparency, verification, certification, and alignment with business operations.

Introduction

To stay below the 1.5 degrees Celsius temperature increase, significant actions are needed—actions that some researchers argue may already be unrealistic. The primary challenge is to minimise emissions by following a stringent pathway. Equally important, but often underexposed, is the necessity to remove up to 10 GtCO2 from the atmosphere annually by 2050.

In this blog article, we will discuss three key reasons why combining emission reductions with offsetting is crucial for achieving net-zero targets. We'll examine the benefits of carbon offsetting, the role of carbon credits in facilitating emission reductions, and how integrating these methods helps address both current and historical emissions. Additionally, we’ll provide guidance on selecting impactful carbon credit projects that align with your company’s values and agenda.

Reason #1: Implementing emission reduction projects takes time. And offsetting offers an immediate solution for unavoidable emissions

Carbon offsetting is often a polarising and misunderstood strategy. Many criticise it, believing it allows polluters to maintain their harmful practices by buying their way out of actual emission reductions. Others see it as a short-term measure that can help initiate the shift towards Net Zero.

In reality, offsetting is a legitimate tool for businesses genuinely dedicated to the Race to Zero. Considering that the implementation of emission reduction projects (such as modifying production processes to reduce industrial emissions; switching to more sustainable transportation; etc.) can take several years, offsetting initiatives catalyse bold, immediate actions for tackling unavoidable emissions.

What is carbon offsetting?

Carbon offsetting is the process of compensating for greenhouse gas emissions by investing in projects or activities that reduce, avoid, or remove an equivalent amount of emissions elsewhere.

What are carbon credits?

Carbon credits are generated by projects that have avoided or removed greenhouse gas emissions. Each credit signifies a reduction of one tonne of carbon dioxide, or its equivalent in other greenhouse gases (CO2e), in the atmosphere.

.png?width=1920&height=1080&name=Body%20(11).png)

These projects depend on the revenue from selling carbon credits to function, and they undergo independent audits to confirm the amount of carbon emissions they have avoided or reduced.

Supported by a scientific consensus, using high-quality carbon offsets for avoidance and removal is crucial for neutralising emissions that can't be reduced by other methods. This is why the carbon offset market is set to expand significantly, from $0.6 billion in 2019 to an estimated $200 billion by 2050.

.png?width=900&height=900&name=Heading%20(3).png)

Offsetting emissions as the primary driver for carbon credit usage

By buying voluntary carbon credits, organisations can offset a portion of their carbon emissions. This practice supports achieving emission reduction targets and helps reach carbon-neutral or net-zero goals.

Adopting a strategic and principled offsetting approach involves prioritising emission reductions within the company’s operations and supply chain, using offsets as a supplementary measure rather than a standalone solution.

It can take time to achieve direct emission reductions, and some emissions are difficult to fully eliminate even with strong decarbonisation efforts. In such cases, offsetting provides a practical and measurable method for taking immediate action on climate commitments and contributes to slowing climate change while continuing efforts to reduce emissions.

Additional benefits of carbon credit usage beyond emissions reduction include:

- Alignment with global initiatives: Purchasing credits can align with global sustainability initiatives, such as the UN Sustainable Development Goals. This alignment underscores a company’s commitment to broader societal and environmental goals, enabling it to meet sustainability targets beyond just decarbonisation.

- Enhancing corporate reputation: Engaging in the voluntary carbon market (VCM) boosts a company's reputation by showcasing a commitment to environmental stewardship and responsible practices, which can positively impact how stakeholders view the company.

- Stakeholder engagement: Carbon credit initiatives offer a clear and impactful way for companies to engage with stakeholders on environmental issues, helping build positive relationships with customers, suppliers, employees, and communities in areas affected by or involved in carbon projects.

Reason #2: Carbon credits provide the mechanism and financing to avoid and remove carbon emissions.

The voluntary carbon market (VCM) is expected to have channelled more than $1.2 billion in investment flows over 2022, helping to mitigate about 161 megatonnes (Mt) of carbon emissions.

Carbon credits provide essential funding for decarbonisation projects globally, helping us achieve our climate targets and aiding communities that are most affected by climate change despite being the least responsible for it.

Carbon credits issued after 2016 contribute to the Paris Agreement climate goals, thus directly supporting the global effort of reaching the net-zero target. These credits are subject to stricter verification and auditing processes to ensure the authenticity and effectiveness of the emissions reduction or removal.

They often support projects that not only remove, reduce, or avoid emissions but also contribute to long-term environmental, social, and economic benefits (e.g. improving health, creating jobs, and fostering resilient communities).

Reason #3: Combining reduction and offsetting helps companies address historic emissions.

Combining carbon offsetting with direct reduction efforts allows companies to neutralise more than their present carbon footprint. They can mitigate historical emissions, this way addressing the legacy of past industrial activities.

In 1950, global CO2 emissions accounted for 6 billion tonnes. By 1990, this figure had nearly quadrupled to over 20 billion tonnes. Emissions have continued to rise rapidly and now exceed 35 billion tonnes annually.

.png?width=1000&height=561&name=Body%20(14).png)

The Science Based Targets initiative’s (SBTi) Net Zero Standard framework recommends that “companies go further and invest in mitigation outside their value chains now to contribute towards reaching societal net-zero”.

This implies that while companies should prioritise tackling absolute emissions reductions within their value chain, they must also invest in Beyond Value Chain Mitigation (BVCM) to help the global economy align with 1.5°C and net-zero.

What is beyond value chain mitigation?

Beyond value chain mitigation is one of the key elements of the Net Zero Standard framework which stipulates that companies are expected to take action to mitigate emissions outside their value chains, such as purchasing high-quality, jurisdictional REDD+ credits or investing in direct air capture.

Some examples of BVCM actions include forestry, conservation projects, energy efficiency projects (e.g. cookstove projects), renewable energy (solar, wind, etc.), methane destruction projects, etc.

Tonne for tonne BVCM model implies purchase and retire of high-quality carbon credits to match some portion of unabated and / or historical emissions.

Why should businesses undertake BVCM?

To bridge the gap between current emissions levels and where we need to be, companies should engage in additional Beyond Value Chain Mitigation (BVCM) activities. By urgently reducing emissions within their value chains and contributing to BVCM efforts beyond tonne for tonne neutralisation, businesses can help preserve the remaining, rapidly shrinking carbon budget1.

It's imperative to start now, take responsibility, and utilise the Voluntary Carbon Market (VCM) and offsetting mechanisms to support innovation and achieve the scale of carbon removal required.

1 A carbon budget represents the total amount of emissions that may be released during an agreed five-year period.

How to invest in carbon credit projects that are high-impact, credible, and long-term focused

Choosing which carbon credits to invest in can be a really difficult task, because there are more than 170 different types of carbon credit projects that either remove or avoid carbon.

Carbon removal credits are issued for projects that remove carbon. These range from nature-based solutions (e.g. reforestation) to engineered solutions, such as direct carbon capture and storage.

Carbon avoidance credits are based on the emissions that might have existed had a project not been funded. Since it's impossible to observe these hypothetical emissions directly, estimates are made using historical data, contextual information, and statistical models to create a baseline representing what would have happened without the project. Some examples include renewable energy projects, energy efficiency improvements, and waste management initiatives.

Carbon avoidance projects focus on preventing or reducing greenhouse gas emissions that would have otherwise occurred. These projects might introduce uncertainty because the emissions baseline is theoretical. If the baseline is inaccurately set, it can lead to over-crediting. Carbon credit consulting firms or standards assess the baseline emissions that would have happened without the project's implementation and then compare these to the actual emissions recorded following the project's implementation.

Despite this inherent uncertainty, high-quality avoidance credits can present strong evidence to support their baselines, significantly reducing uncertainty. Advances in datasets, statistical techniques, and methodologies are enhancing the accuracy and reliability of avoidance credits.

How do you choose what carbon projects to invest in?

When selecting a carbon project to invest in, it's important to ensure that the project delivers the intended impact. Here are some key considerations to guide your decision:

- Financial transparency: Ensure the project is clear about where the carbon credit revenue goes. Transparency in financial matters helps verify that funds are used effectively and ethically.

- Verification: The project should be independently verified to confirm that each carbon credit represents one ton of CO2 reduced or removed. Avoid projects that lack proper verification or fail to demonstrate their impact.

- Certification: Choose projects that are certified by reputable organisations and have a robust monitoring and reporting framework. Some of the most common (inter)national standards include: Gold Standard; VCS Verra; Plan Vivo; Climate Action Reserve; American Credit Registry These internationally recognised certification bodies are pivotal in assessing the environmental impacts of carbon credit projects.

- Alignment with business operations: Choose projects that align with your company’s operations or geographical region. While reducing or removing a ton of carbon emissions is beneficial no matter where it occurs globally, the carbon offset projects you support can offer additional benefits beyond offsetting emissions.

These co-benefits might include ecosystem and biodiversity restoration, community health improvements, or the creation of sustainable income sources for rural areas.

Opting for carbon credit projects near your business location can enhance environmental quality in your local community or region. Alternatively, selecting projects near businesses in your value chain can help mitigate the environmental impacts of your operations and provide benefits to the communities where your partners are situated.

More so, choosing carbon credit projects geographically close to your business can make it easier to communicate the project's impact to stakeholders.

- Strategic fit: If your company prioritises biodiversity, for example, select a project that supports biodiversity conservation. This alignment enhances the credibility and relevance of your sustainability efforts.

- Community socio-economic benefits: Depending on the project's location and type, it may provide additional benefits such as employment opportunities, improved water access, and enhanced educational facilities.

GoodCriteria by GoodZero: A comprehensive approach to sourcing high-impact carbon credit projects

Not all carbon credits are created equal. And though a project might have been verified by relevant international organisations, it still benefits from third-party due diligence. This way, one can ensure that the carbon credit projects in question genuinely deliver their environmental promises.

For GoodZero, we have developed a set of meticulous evaluation criteria – GoodCriteria – which ensure that the projects we offer not only reduce greenhouse gas emissions but also have benefits that support the wider community. While most verification standards mostly focus on a project's climate impact, we also assess its carbon integrity.

.png?width=1920&height=620&name=Body%20(1920%20x%201000%20px).png)

Carbon integrity is comprised of multiple factors, such as:

- Social impact

Offsets must protect the self-determination of local communities and Indigenous People.

- Social stability

We examine social impact, for example, political instability, human rights jeopardy, and natural or other external risks.

- Sustainability

We examine projects to ensure their offsets do not cause any environmental or social net negative impacts.

- Sustainable Development Goals

We check which SDGs the project meets.

- Biodiversity

We check the impact on biodiversity.

- Externalities

We examine projects on political risks and other external factors.

- Credit Clarity

We strive to provide carbon-price transparency to our clients. For example, we check if the project developers can show how the proceeds are reinvested into project developments, including the manner and the percentage of the reinvestment.

After performing the extra due diligence through GoodCriteria, we’ve selected the following carbon credit projects we believe you would be proud of supporting

African Clean Energy

Gold Standard verified African Clean Energy (ACE) is a B-Corp certified company that has developed the ACE-One, a clean energy system that has both climate and social benefits for Sub-Saharan African and Southeast Asian communities. Learn more about the project via the link.

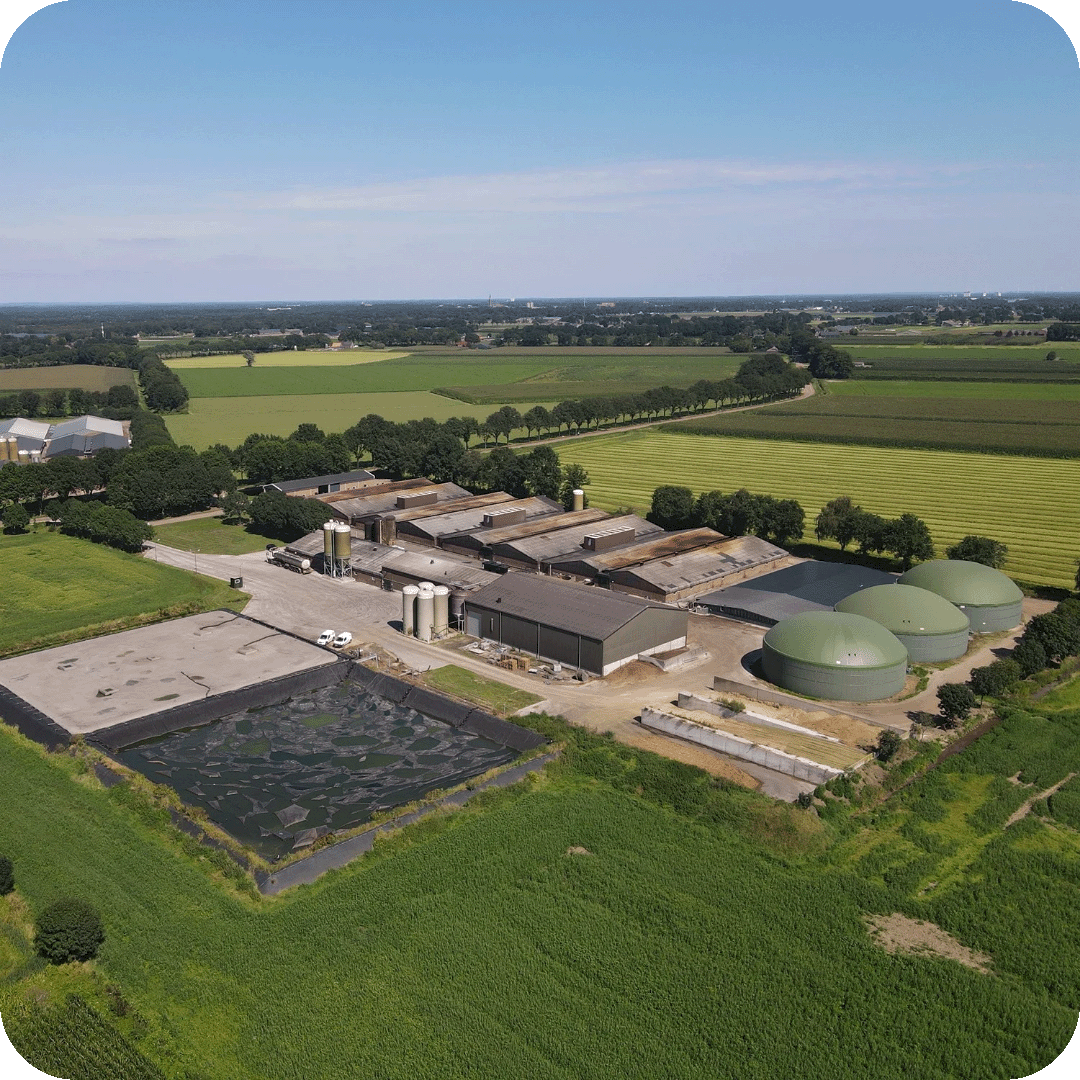

Dutch Methane Recovery Project

The Dutch Methane Recovery project aims to mitigate the environmental impact of livestock farming by capturing methane emissions from manure. Three Dutch farms are working closely together to implement an enhanced manure management process that captures and converts methane into renewable energy (biogas). By doing so, the project not only reduces greenhouse gas emissions but also generates thermal energy for own farming operations. Carbon credits are certified through Verra. Learn more about the project via the link.

CarbonCure

CarbonCure injects captured CO2 into concrete, where the CO2 mineralises and enables emissions reductions through cement cuts, creating the same high-quality product with a reduced carbon footprint. Learn more about the project via the link.

Trefadder

Trefadder, Norway's leading BIO-carbon capture specialist, develops climate forests to capture significant CO2 emissions. This comprehensive approach, guided by international standards and ISO certification, ensures optimal carbon sequestration through rigorous planting methods, biodiversity preservation, and meticulous documentation. Learn more about the project via the link.

More news and blogs

GZ | News & Blogs | 03-06-2024

Reducing and offsetting – 3 reasons you should embrace both to reach your net-zero targets

Read this story

GZ | News & Blogs | 18-04-2024

GoodZero and CIRRO: Strategic Partnership for a Greener Tomorrow

Read this story

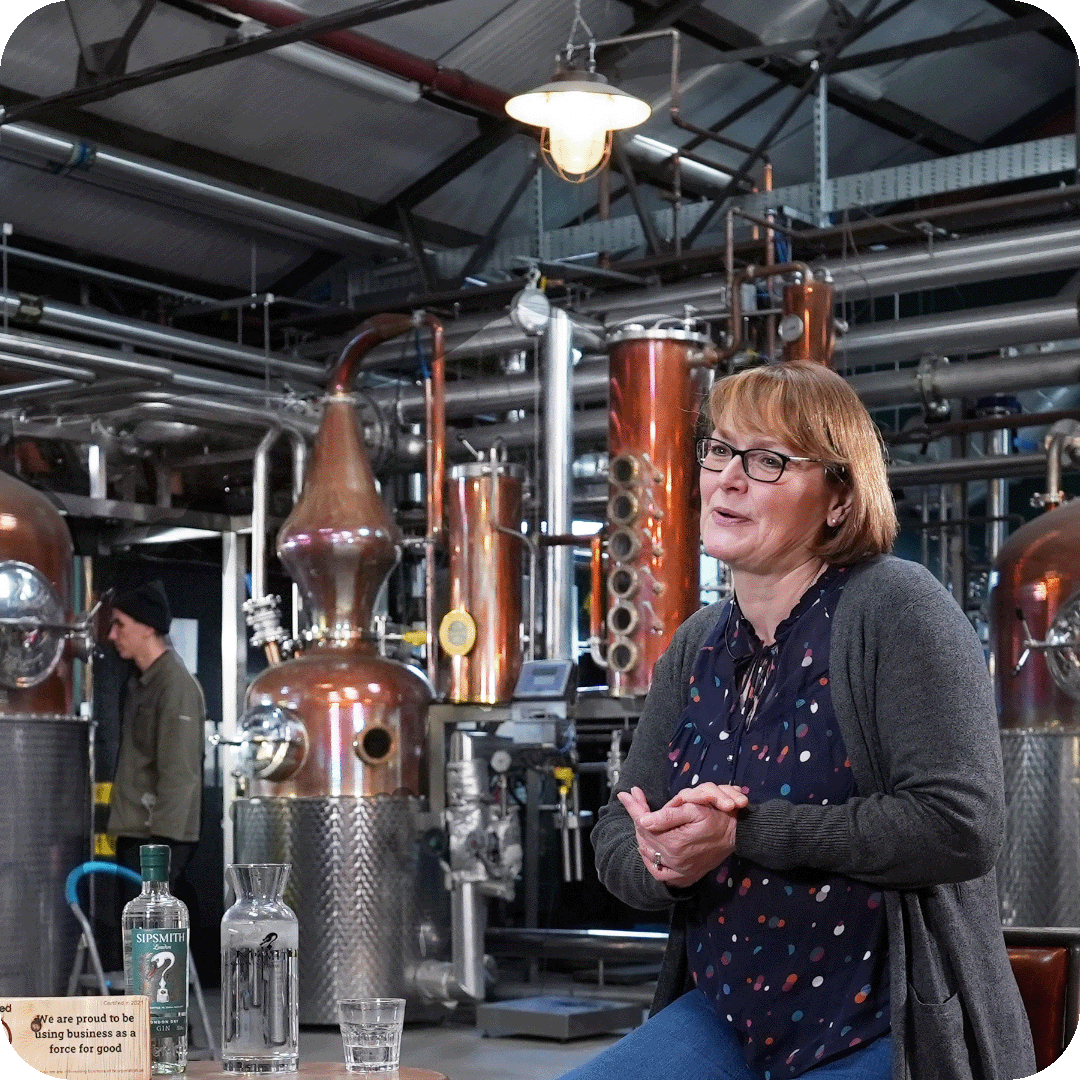

GZ | News & Blogs | 19-03-2024

A perfect fit : How Sipsmith aligns emissions offsetting with their core values

Read this story

Ready to explore

more?

more?

.png)